Blockunity brings clarity to crypto data. Your source for simplified insights and analytics.

Unify Your Data Needs In One Block

Navigating the

Crypto Data Maze?

Discover real-time crypto data, cryptocurrency statistics, and market insights to transform confusion into clarity.

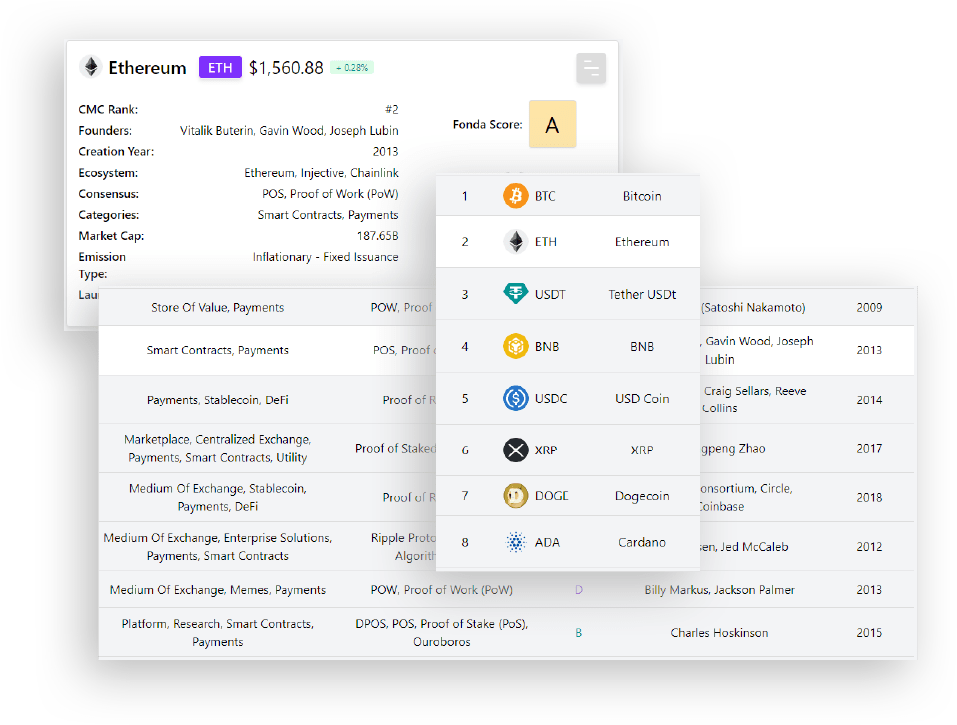

We’re more than a crypto data provider. Blockunity offers a streamlined app with precise crypto data visualization and in-depth cryptocurrency data analytics. Here, clarity meets accuracy, ensuring you’re always one step ahead in your crypto journey.

One step from Data-Driven Success

Aggregation, Correlation, and Democratization at your fingertips.

Market Data

Get the lastest Market Trends.

On-Chain Data

Analyze Blockchain Tx.

Fundamental Data

Access Essential Data.

Off-Chain Data

Discover Off-chain Insights.

Technical Data

Go Technical Today.

Driven by Data,

Inspired by Simplicity

Guiding your crypto journey with purpose.

Born from the challenges of navigating crypto investments, Blockunity was brought to life by a passionate experienced and resilient team. We provide clarity in a complex world, empowering both novices and intermediates.

Beyond Data - Expanding your crypto toolkit

While data remains our forte, explore a suite of tools designed to further elevate your crypto endeavors.

Strategy Builder

Unlock advanced trading strategies with our Strategy Builder.

Portfolio Tracking

Monitor and optimize your investments effortlessly with our Portfolio Tracker.

Powerful Indicators

Advanced indicators for real-time market analysis and trend forecasting.

Trusted by All-Level Traders & Investors

For me, Blockunity represents THE professional project, with a team that listens, reacts and is always available! I needed tools to optimize my crypto investments, and Blockunity delivers.

Whether it’s for portfolio monitoring, on-chain analysis or Unyx Data indicators, everything is top notch!

CFreeman1978

Blockunity isn’t just a project.

It’s a powerful tool which, when used intelligently, saves me countless hours of research, analysis and follow-up.

Blockunity is also a responsive team that listens to its community.

Julien S

Impressed by Blockunity!

Their analysis tools and Unyx Data really helped me understand the crypto market. The team is very responsive and reliable, which gave me confidence to invest.

Thanks to them I’ve transformed my approach to crypto investing. I recommend their services!

Mitche666

Blockunity is the ideal all-in-one platform for crypto investors, there’s an advanced and fully customizable market screener. The Unyx Data are invaluable for detecting buy and sell points among other things. The advanced portfolio tracker is also very useful for keeping track of our investments. The strategy builder is very well done, and will eventually enable us to automate our position-taking and optimize returns 24 hours a day.

Everything is developed by a very responsive team that listens to the community.

Foxydemon

Blockunity offers an essential set of tools as an active cryptocurrency investor. The fundamental evaluation system and Unyx Data simplify my technical analysis. The Strategy Builder allows me to optimize my strategies without programming. More than just a tool, Blockunity is a committed community that provides quality content for our education.

The team shows an undeniable passion for their customers’ success, and I strongly encourage them to continue their excellent work.

Misty

Dive Deeper with our Insights

Guide du débutant pour comprendre la synergie entre le BPS et le BOS

Comprendre le comportement des détenteurs de tokens et la distribution de la propriété est essentiel dans les marchés de la crypto-monnai...

Mar 19, 2024 / Read More

Blockunity et Cede : Vers une gestion de portefeuille facilitée

Dans la cryptosphère, la gestion de portefeuille est un facteur crucial de succès. C’est dans cette optique que Blockunity, spécialiste e...

Mar 11, 2024 / Read More

Guide du Débutant pour comprendre le Blockunity Drawdown Visualizer

Dans le monde en constante évolution de l’investissement en cryptomonnaies, comprendre les concepts clés et les stratégies de gestion des...

Feb 27, 2024 / Read More

Maîtriser l’Art du Breakout, du Piège et du Retest dans l’Investissement en Crypto

“Maîtriser l’Art du Breakout, du Piège et du Retest dans l’Investissement en Crypto” est un guide exhaustif conçu pour ceux qui s’aventur...

Feb 06, 2024 / Read More

Mastering the Art of Breakout, Trap & Retest in Crypto Investing

“Mastering the Art of Breakout, Trap & Retest in Crypto Investing,” is a comprehensive guide designed for those venturing into the dynami...

Feb 02, 2024 / Read More

Rétrospective de CryptoXR, l’évènement crypto à ne pas manquer !

CryptoXR, bien plus qu’un simple événement, s’est avéré être une communion exaltante de la communauté crypto. Voici un aperçu de ce qui a...

Jan 31, 2024 / Read More

Mastering Market Trends: Your Essential Guide to Key Levels in Crypto Trading & Investing

This article explores key levels in crypto investing & trading, covering support/resistance, psychological levels, Fibonacci retracements...

Nov 26, 2023 / Read More

Navigating Extremes: From Overbought to Oversold

In the fast-paced world of cryptocurrency trading, understanding overbought and oversold conditions is crucial. Overbought conditions occ...

Nov 02, 2023 / Read More

Unyx Data: Tools for beginner and experienced traders — Simplify your trading.

(Retrouvez une version française plus bas dans l’article)

Oct 25, 2023 / Read More

Tokenomics Masterclass: Analyzing & Exploiting Information for Informed Decisions

The world of cryptocurrency is vast and varied, with thousands of digital assets, each with its unique economic model. Enter tokenomics —...

Oct 11, 2023 / Read More

Ready to level up?

Take the next step in your crypto journey with us by you side. Join crypto data excellence.